7 Simple Techniques For Fortitude Financial Group

7 Simple Techniques For Fortitude Financial Group

Blog Article

More About Fortitude Financial Group

Table of ContentsFortitude Financial Group Fundamentals ExplainedFortitude Financial Group - An OverviewFortitude Financial Group Fundamentals ExplainedThe Greatest Guide To Fortitude Financial Group

With the appropriate strategy in area, your money can go even more to assist the organizations whose objectives are aligned with your values. A monetary expert can aid you specify your philanthropic giving goals and include them right into your monetary plan. They can additionally suggest you in ideal means to maximize your offering and tax deductions.If your organization is a partnership, you will wish to experience the sequence preparation process together - Financial Services in St. Petersburg, FL. An economic expert can help you and your partners comprehend the vital elements in organization succession preparation, establish the worth of business, develop investor agreements, develop a payment framework for successors, summary change options, and a lot more

The key is finding the appropriate monetary consultant for your scenario; you may end up interesting different experts at different phases of your life. Attempt contacting your financial establishment for referrals.

Your next action is to consult with a qualified, licensed expert that can supply suggestions customized to your specific situations. Nothing in this write-up, nor in any type of associated resources, need to be taken as financial or legal suggestions. Additionally, while we have actually made great faith efforts to ensure that the information offered was appropriate as of the date the web content was prepared, we are not able to assure that it remains exact today.

Some Ideas on Fortitude Financial Group You Need To Know

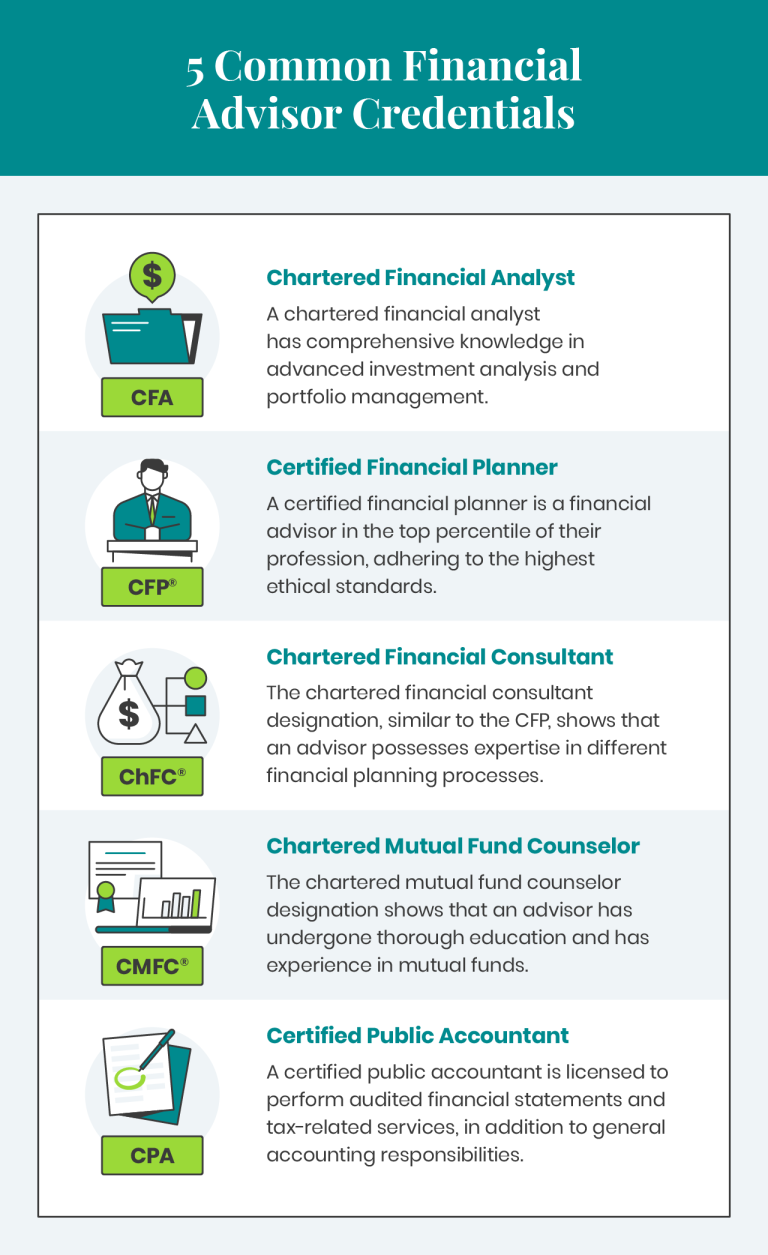

Financial consultants aid you choose concerning what to do with your money. They guide their clients on saving for significant purchases, putting cash apart for retired life, and spending money for the future. They can also recommend on current financial and market activity. Allow's take a better consider exactly what a financial consultant does.

Advisors utilize their knowledge and proficiency to construct individualized financial plans that aim to attain the economic goals of customers (https://www.indiegogo.com/individuals/38024181). These plans include not just investments yet likewise cost savings, budget, insurance coverage, and tax obligation strategies. Advisors additionally check in with their clients regularly to re-evaluate their current circumstance and plan accordingly

The Basic Principles Of Fortitude Financial Group

Let's say you intend to retire in 20 years or send your kid to an exclusive college in ten years. To accomplish your objectives, you may require a proficient professional with the appropriate licenses to assist make these strategies a fact; this is where a monetary expert comes in (Investment Planners in St. Petersburg, Florida). With each other, you and your consultant will certainly cover lots of topics, including the quantity of cash you ought to conserve, the sorts of accounts you need, the type of insurance policy you need to have (consisting of lasting care, term life, handicap, and so on), and estate and tax obligation preparation.

Financial advisors offer a variety of services to clients, whether that's providing reliable general financial investment suggestions or aiding in getting to a monetary goal like buying a college education and learning fund. Below, discover a listing of the most usual solutions provided by monetary advisors.: An economic consultant uses advice on financial investments that fit your style, goals, and risk tolerance, creating and adjusting investing strategy as needed.: An economic expert creates approaches to assist you pay your financial obligation and stay clear of financial obligation in the future.: A financial expert offers suggestions and techniques to create spending plans that help you meet your goals in the brief and the long term.: Component of a budgeting technique might include approaches that aid you spend for higher education.: Similarly, a financial advisor creates a saving plan crafted to your specific requirements as you head into retirement. https://moz.com/community/q/user/fortitudefg1.: An economic advisor aids you identify the individuals or companies you intend to obtain your heritage after Visit Website you pass away and develops a strategy to execute your wishes.: A monetary expert gives you with the most effective lasting services and insurance policy options that fit your budget.: When it pertains to taxes, a financial expert might aid you prepare income tax return, make the most of tax obligation deductions so you get one of the most out of the system, timetable tax-loss gathering protection sales, ensure the most effective use the funding gains tax rates, or plan to minimize taxes in retirement

On the survey, you will certainly likewise show future pensions and revenue sources, project retirement needs, and describe any kind of long-lasting economic commitments. Basically, you'll list all existing and predicted investments, pension plans, presents, and income sources. The spending element of the survey touches upon more subjective subjects, such as your risk tolerance and danger capacity.

Unknown Facts About Fortitude Financial Group

At this factor, you'll likewise allow your advisor understand your investment choices. The initial assessment may also include an assessment of various other financial administration subjects, such as insurance coverage issues and your tax obligation scenario.

Report this page